EZ Home Financing

Own A Home, Even If Banks Said No

Fast, flexible owner-financing for homebuyers, homeowners, and investors. No perfect credit required.

• Approval in 24 - 48 hours

• All Credit Qualifies

• Fast approvals—even for first-time investors

• No prepayment penalty

• No Balloon Payments

• 30 year fixed mortgage as low as 9.99%

• Hablamos Español

Talk To A Specialist Today!

About Us

TruWealth Capital offers fast, flexible financing for first-time buyers and anyone banks won’t approve. We underwrite your ability to repay based on the property’s potential—not perfect credit or piles of paperwork. Get pre‑approved in 24–48 hours and funded in weeks (sooner when needed). Our team guides you end‑to‑end so you can achieve homeownership with clear terms and less hassle—even if traditional lending hasn’t worked yet.

EZ Home Financing vs. Conventional Financing

EZ Home Financing

Faster Approval Process: Approved in 24-48 hours versus 14-30+ days for conventional loans

Fewer Qualification Requirements: No need for W-2s, tax returns, income verification, or perfect credit

Focus on Property Value: Lenders care more about the deal than personal finances

Accessible Home Ownership for All: Traditional lenders often have stringent credit score requirements that can be a barrier for many buyers

No Limit on Number of Properties: Unlike conventional loans which typically cap at 10 properties

More Flexible Lending: Better suited homebuyers not able to qualify to purchase a home, bad credit, buyers that don't have 20% - 30% for their home purchase

Realtors/Lenders: We often rescue deals that are falling apart at the closing table as we approve in 24-48 hours

Transparency: Our bilingual Transaction Coordinators offer personalized support throughout the entire home buying process, ensuring a smooth and stress-free experience!

Experience Can Substitute for Perfect Credit: Compensating factors can offset lower credit scores

Conventional Financing

Stringent Qualification Process: Requires good credit, income verification, tax returns, & more every year.

Debt-To-Income Ratio Limits: Typically 43-45% maximum

Slower Approval Process: Often 30-45+ days to close

Lower Leverage: Usually limited to 75-80% LTV with no rehab funds or monthly mortgage payments rolled into your loan repayment

Limit on Number of Mortgages: Typically capped at 10 conventional loans

Strict Property Requirements: Lenders have more and more requirements about the type of properties they will lend on. With us, we do our best to get as many people as possible approved.

Personal Credit: With lenders becoming more risk averse, the requirements for homeownership continue to rise and makes it harder to own a home.

Less Flexibility: Terms designed for anyone that wants to purchase their first home or for their growing family

Why EZ Home Financing?

• All Credit Welcome

• Own without the bank runaround. Real approvals, real timelines.

• Fast, Transparent Decisions

• 24–48h pre‑approval with clear terms and next steps.

• Personal, Bilingual Support

• Dedicated coordinators who guide you from “apply” to “keys.”

• Lower Upfront Options

• Special inventory with reduced down payments and closing costs (when available).

Who We Serve

• Homebuyers/Homeowners: Enter homeownership when traditional mortgages aren’t an option. Flexible down payments, clear terms, hands‑on guidance.

• For Realtors/Mortgage Brokers/Private Money Lenders/Brokers: We say “yes” to clients banks decline. No hidden fees. Keep your full commission. (Ask us about our free webinars we host and answer your questions)

• For Investors: Turn properties into income with owner‑finance programs. IRA‑friendly options, non‑recourse/asset‑based in many cases, streamlined underwriting.24–48h pre‑approval with clear terms and next steps.

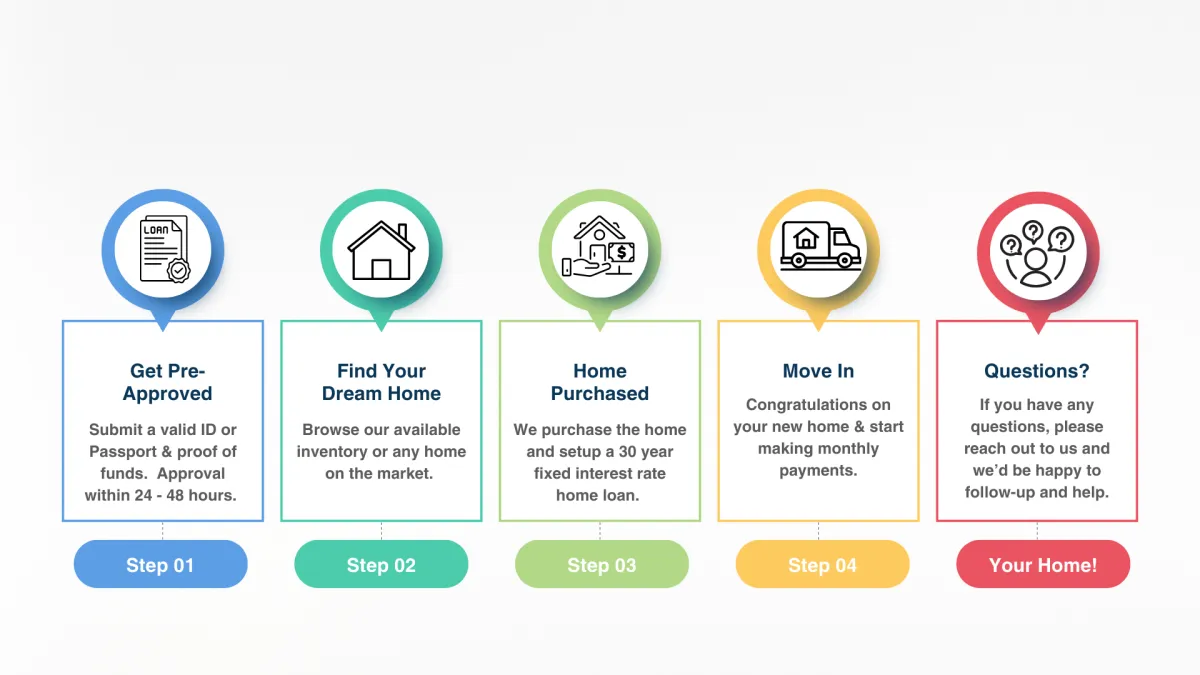

How it Works

What You Get With Us

• 24 - 48 hours pre-approval

• Great service from fast, efficient, friendly staff, and bilingual staff (Spanish)

• Transparent payment and amortization schedule

• Closing checklist & timeline

• Servicing setup and support

• Realtors/Investors collaboration (when applicable)

• Lower Upfront Options

• Special inventory with reduced down payments and closing costs (when available)

Bonuses

• Down-payment optimizer (pick the structure that fits your budget)

• Closing costs navigator (line-item map to avoid any surprises)

• Refi-readiness plan (how to graduate to a lower interest rate loan later)

• Servicing setup and support

• Realtors/Investors collaboration (when applicable)

• Personalized, best-in-class service, bilingual teammates, and expert team

Rates & Terms

• Fixed 30 year mortgage rates starting at 9.99%

• Flexible down-payment options on select inventory (where applicable)

• Clear fees disclosed up front; no surprises

• Servicing setup and support

• Realtors/Investors collaboration (when applicable)

• Personalized, best-in-class service, bilingual teammates, and expert team

Frequently Asked Questions (FAQs)

What are the Loan Terms and Can They Change?

The loan terms are 9.99% interest / 30-Year fixed rate and not the terms will not change

What Type of Documentation do I Need to Qualify?

• Valid ID or Passport

• Proof of current funds (as low as 10% but typically 25-30% of the purchase price)

• Completed pre-approval application

• Verification of employment or ability to make monthly mortgage payments

Do I need to Have Good Credit?

No, your credit score will not affect your ability to qualify for a loan.

How Long Does it Take to be Pre-approved?

It takes 24-48 hours once the application and proof of funds are received.

Is There a Pre-Payment Penalty or Balloon Payment?

No

What Kind of Service & Support can I Expect During the Financing Process?

We provide transparent and guided support throughout the entire financing process & here to answer your questions.

How Much are Closing Costs?

Closing costs typically average around 5%. We use 5% as the standard for pre-approval, but the exact amount will be confirmed in your Closing Disclosure 3 days before closing.

What’s Included in my Monthly Payment?

Monthly payments include principal and interest only. Final amounts for taxes and insurance are added 3 days before closing, so be sure to factor those in when estimating your total payment.

Have Further Questions?

We’re here to ensure that your house buying experience is smooth and hassle-free as possible. Please at [email protected] if you have further questions that haven’t been answered on our site. We will be happy to assist you!

Ready to Make Home Ownership Happen?

From the moment you apply to the day you close, our team is here to support you every step of the way. We make the process smooth, transparent, and efficient — so you can move forward with confidence, avoid unnecessary delays.